According to Refinitiv Datastream 67 of SP 500 constituents are. The SP 500 is trading with a.

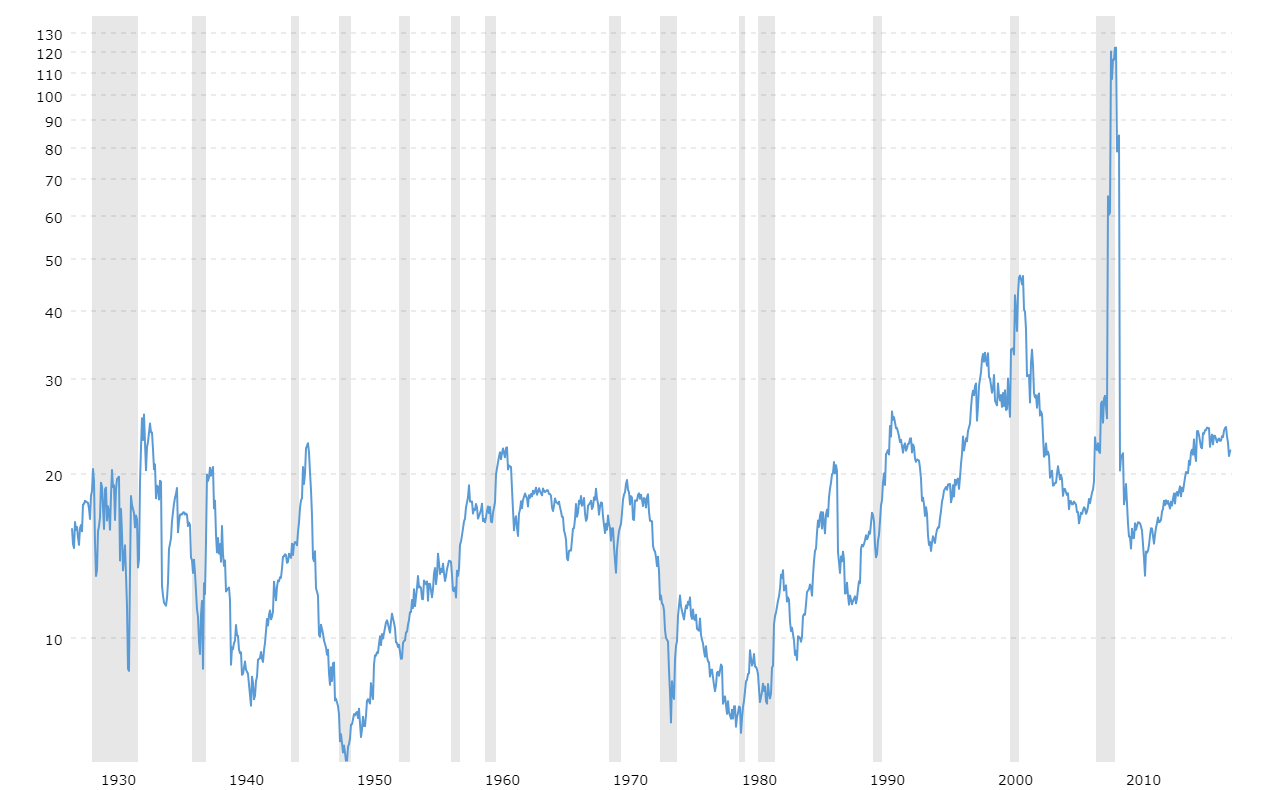

S P 500 Pe Ratio 90 Year Historical Chart Macrotrends

S P 500 Pe Ratio 90 Year Historical Chart Macrotrends

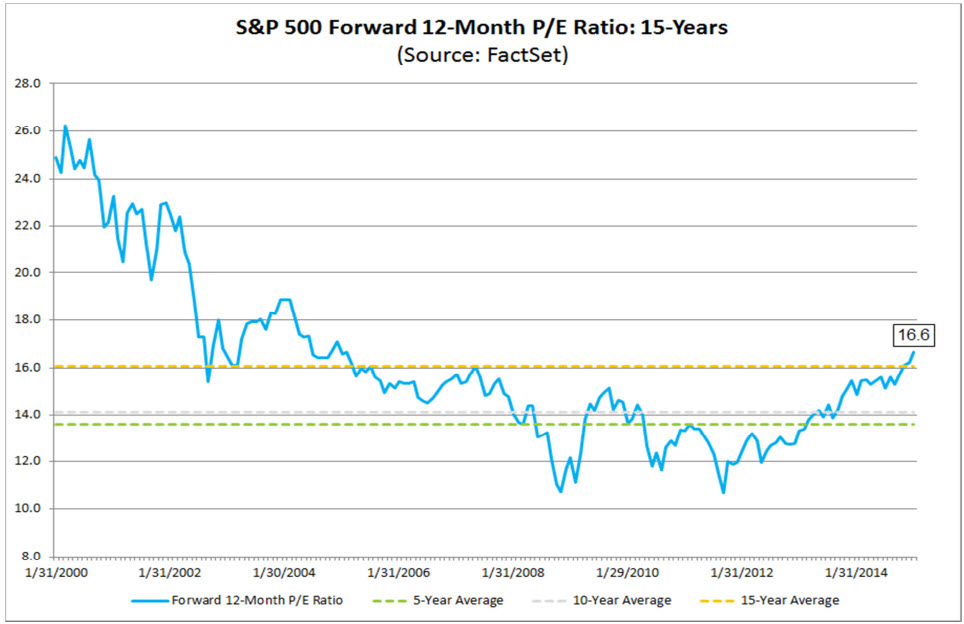

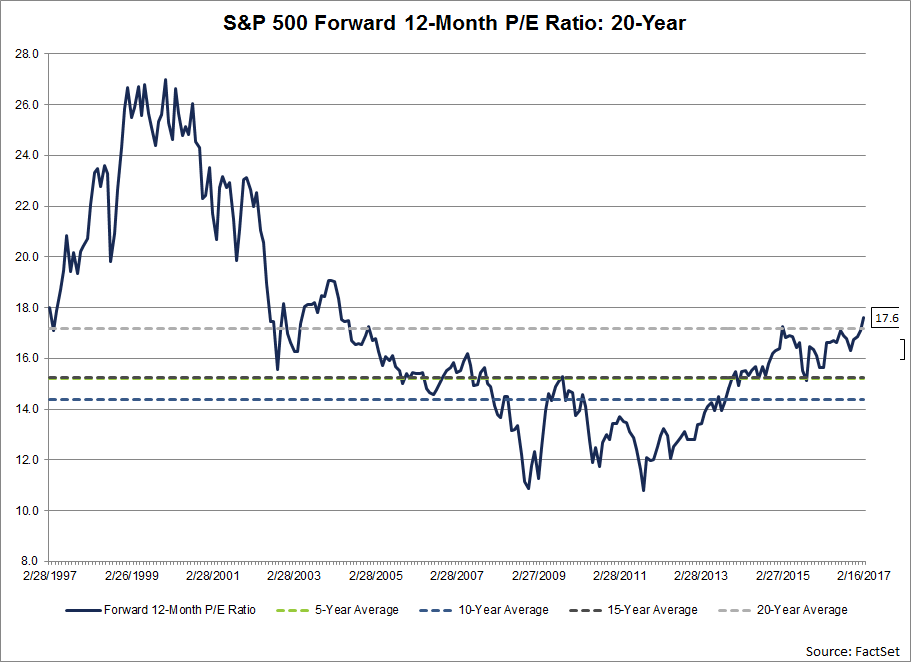

1292020 The forward 12-month PE ratio of 187 on January 17 was above the four most recent historical averages for the SP 500.

Forward p e ratio s&p 500. Current SP 500 PE Ratio Data. The forward PE on the other hand would be 50 5 x 110 91x. 632020 SP 500 FORWARD PE RATIOS SP 500 Index 216 Consumer Discretionary 340 Information Technology 252 Price divided by 12-month forward consensus expected operating earnings per share.

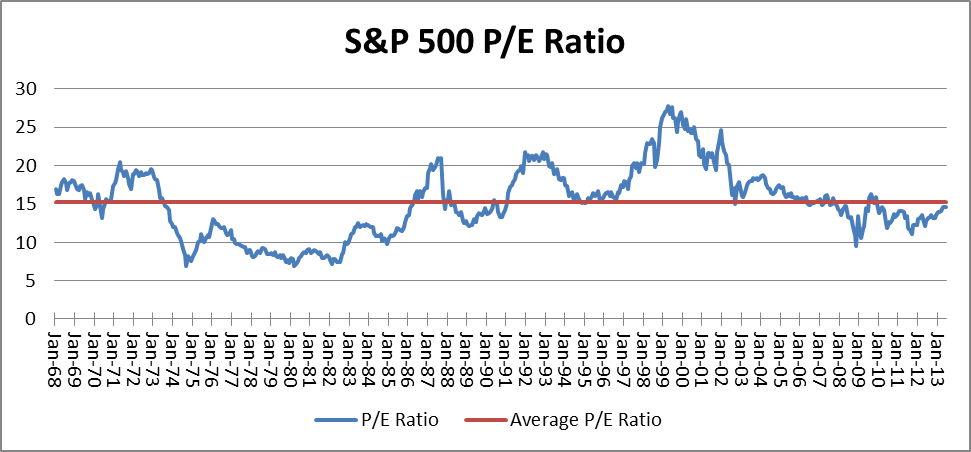

PE data based on as-reported earnings. According to Refinitiv Datastream 67 of SP 500 constituents are trading above its historical 10-year average forward PE. Estimate data based on operating earnings.

As of January 20 2021 the SP 500 was at 3848 and had a forward PE ratio of 256. Five-year 167 10-year 151 15-year 146 and 20-year 154. This ratio is in the 84th percentile of the historical distribution and was only exceeded during the early 2000s and the 2008-2009 recession.

In fact this marked the first time the forward 12-month PE had been equal to or above 187 since May 28 2002 also 187. This is a change of -339 from last quarter and. SP 500 PE Ratio chart historic and current data.

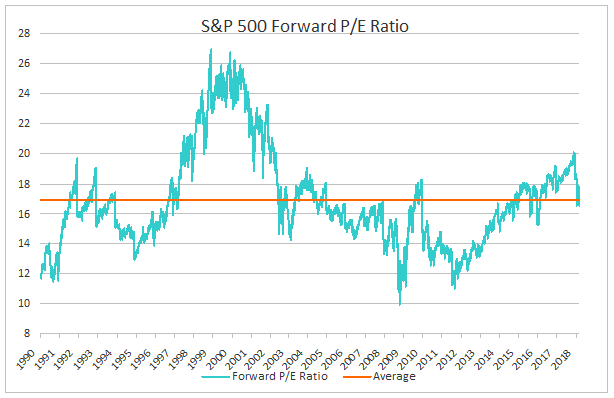

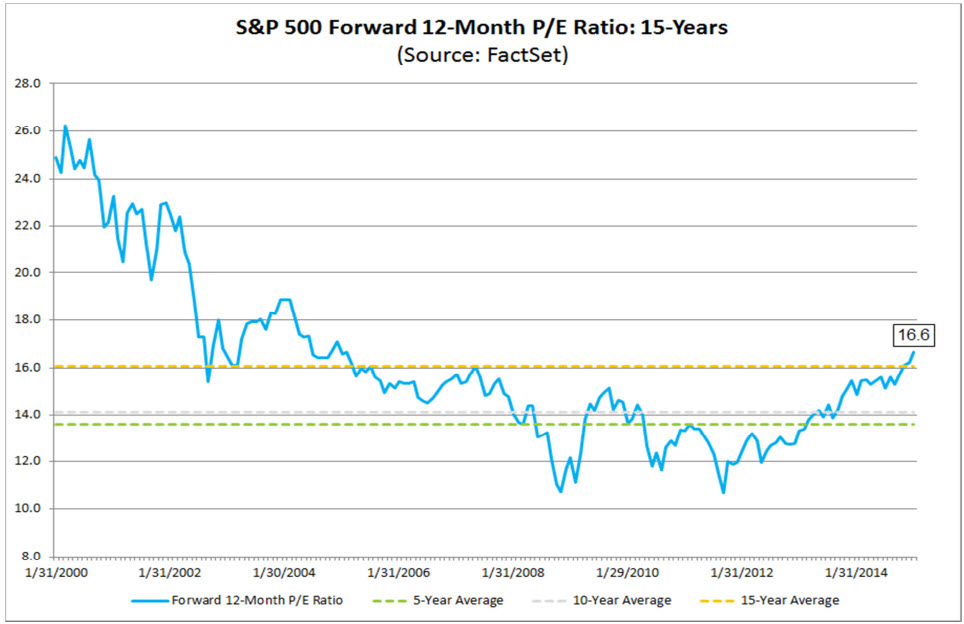

652020 SP 500 Forward PE Ratio 221 SP 500 Median Forward PE 200 Average weekly price divided by 52-week forward consensus expected operating earnings per share. SP 500 by President From Election Date SP 500 Historical Annual Returns. The forward PE rose dramatically in the late 1990s in retrospect perhaps signaling the end of the stock market boom.

IBES data by Refinitiv. This is based on the estimated earnings in 2021 of 15006. Note that analyst earnings estimates are usually considered to be biased high.

RBCs data shows the market. In fact this past week marked the first time the forward 12-month PE ratio had been equal to or above 200 since April 10 2002 200. This interactive chart shows the trailing twelve month SP 500 PE ratio or price-to-earnings ratio back to 1926.

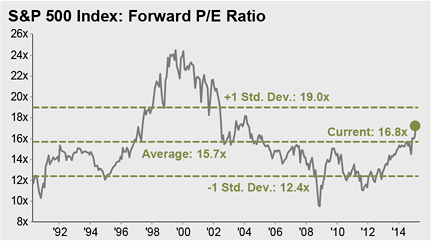

8102015 The average SP 500 PE forward ratio for the period 1990 to July 2015 is 165. The forward PE should not be taken as an infallible indicator of. SP 500 Page 4 April 1 2021 Stock Market Briefing.

10212020 The forward 12-month PE ratio for the SP 500 is 217x in comparison to a 10-year average of 157x representing a 38 premium. SP 500 - 90 Year Historical Chart. SP 500 YTD Performance.

The PE ratio of the SP 500 divides the index current market price by the reported earnings of the trailing twelve months. 6232020 The forward SP 500 PE ratio which is measured using earnings estimates for the next 12 months has jumped to 2218 near its highest levels in almost two decades. In 2009 when earnings fell close to zero the ratio got out of whack.

5132020 The SP 500 traded at a forward price-earnings ratio of 204 last week which is above its five-year 10-year 15-year and 20-year average and is the highest since April 2002. A solution to this phenomenon is to divide the price by the average inflation-adjusted earnings of the previous 10 years. Note that the forward PE is smaller than the current PE since the.

What is PE Ratio. Current SP 500 PE Ratio is 4093 a change of 048 from previous market close. IBES data by Refinitiv.

SP 500 -. Dow Jones Market Data Other Indexes Thursday April 01 2021. 1212021 With growth stocks continuing to rally the average PE ratio of the major indexes like the SP 500 are looking stretched.

10202020 The forward 12-month PE ratio for the SP 500 is 217x in comparison to a 10-year average of 157x representing a 38 premium. 5-year 167 10-year 149 15-year 145 and 20-year 155. SP 500 Sector Forward PEs Page 1 March 31 2021 SP 500 Sectors.

The company has a current PE ratio of 50 5 10x. 5112020 The forward 12-month PE ratio of 204 on May 7 was above the four most recent historical averages for the SP 500. Data as of 2021-04-01 1400 CST.

SP 500 PE Ratio Forward Estimate is at a current level of 2135 down from 2210 last quarter and down from 2470 one year ago. Master the market with. Want to learn more.

This means that the SP 500 companies are expected to report earnings of 15006 for each 3848 of equity market value. The SP 500 PE ratio as of June 1 2017 was 257x which is 3247 higher than the historical average of 194x.

Buying The Dip Greenview Advisors

Buying The Dip Greenview Advisors

The S P 500 Is Overvalued Based On P E Ratio

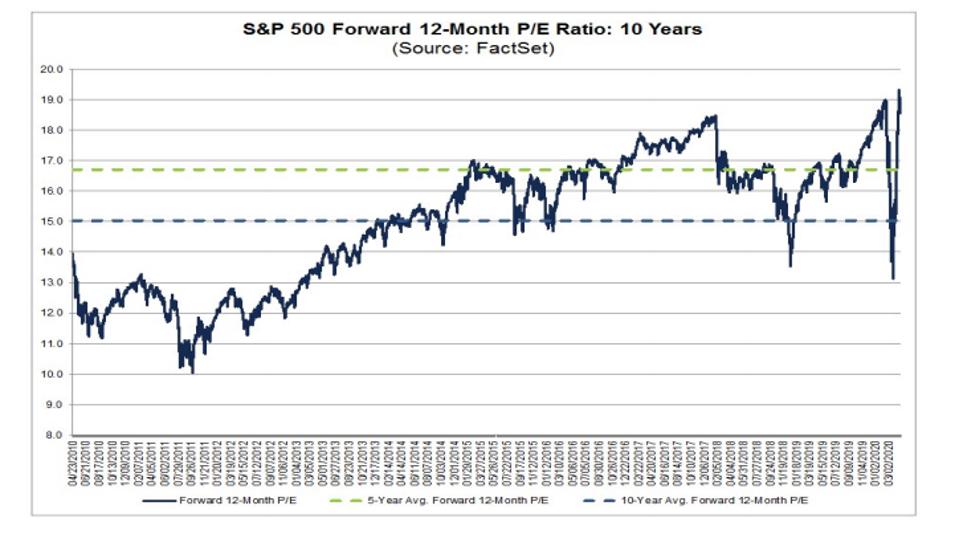

Insight/2020/03.2020/03.13.2020_EI/S&P%20500%20Forward%2012-Month%20PE%20Ratio%2010%20Years.png?width=912&name=S&P%20500%20Forward%2012-Month%20PE%20Ratio%2010%20Years.png) S P 500 Forward P E Ratio Falls Below 10 Year Average Of 15 0

S P 500 Forward P E Ratio Falls Below 10 Year Average Of 15 0

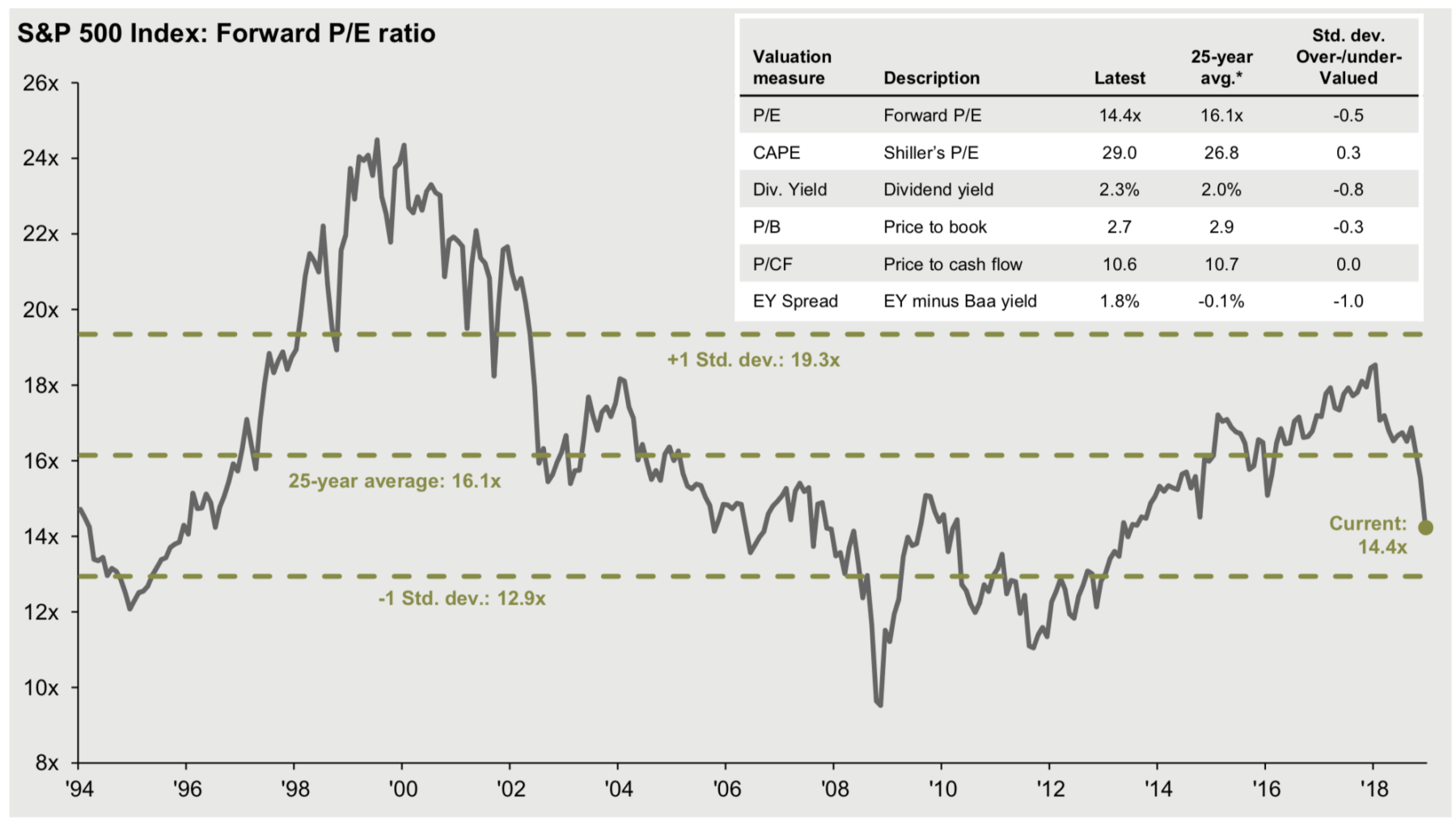

Forward P E Says Stocks Now Fair To Cheap Nysearca Spy Seeking Alpha

Forward P E Says Stocks Now Fair To Cheap Nysearca Spy Seeking Alpha

S P 500 Forward 12 Month P E Ratio Chart Topforeignstocks Com

S P 500 Forward 12 Month P E Ratio Chart Topforeignstocks Com

Highest Spx Forward P E Since 2005 Highest Energy Forward P E Since 2002

Highest Spx Forward P E Since 2005 Highest Energy Forward P E Since 2002

:max_bytes(150000):strip_icc()/ScreenShot2020-05-14at5.58.39AM-7cb97c6836064874aa488b4d974c162c.png) Are Stocks Too Hot For A Pandemic

Are Stocks Too Hot For A Pandemic

Insight/2020/05.2020/05.11.2020_TOW/S&P%20500%20Forward%2012-Month%20PE%20Ratio%2020%20Years.png?width=912&name=S&P%20500%20Forward%2012-Month%20PE%20Ratio%2020%20Years.png) S P 500 Forward P E Ratio Rises Above 20 0 As Eps Estimates Continue To Fall

S P 500 Forward P E Ratio Rises Above 20 0 As Eps Estimates Continue To Fall

Is Market Valuation Telling Us Anything Nevada Retirement Planners

Is Market Valuation Telling Us Anything Nevada Retirement Planners

Price Earnings Ratio Wikipedia

Price Earnings Ratio Wikipedia

S P 500 Index Forward P E Ratio The Big Picture

S P 500 Index Forward P E Ratio The Big Picture

Comparing P E Ratios The S P 500 Forward P E And The Cape Valuewalk Premium

Comparing P E Ratios The S P 500 Forward P E And The Cape Valuewalk Premium

Stocks Keep Moving Higher Even As Earnings Estimates Continue To Fall

Stocks Keep Moving Higher Even As Earnings Estimates Continue To Fall

Price Earnings Ratio Wikipedia

Price Earnings Ratio Wikipedia