The Impact of the Highly Improbable. To investing comes in which you can read more about here.

Using The Barbell Portfolio Strategy To Capture Positive Asymmetry Speculators Anonymous

Using The Barbell Portfolio Strategy To Capture Positive Asymmetry Speculators Anonymous

Universa both formalized and institutionalized the idea of tail risk hedging in 2007 providing live tail risk mitigation for clients during and since the 2008 crisis.

Nassim taleb investment strategy. 1112020 Nassim Talebs barbell strategy is one of the most fascinating concepts in the investing world. 11102014 Nassim Taleb the author of The Black Swan paints a much more subdued picture of the risk inherent to the stock market. Taleb advocates the use of it in his books and writings.

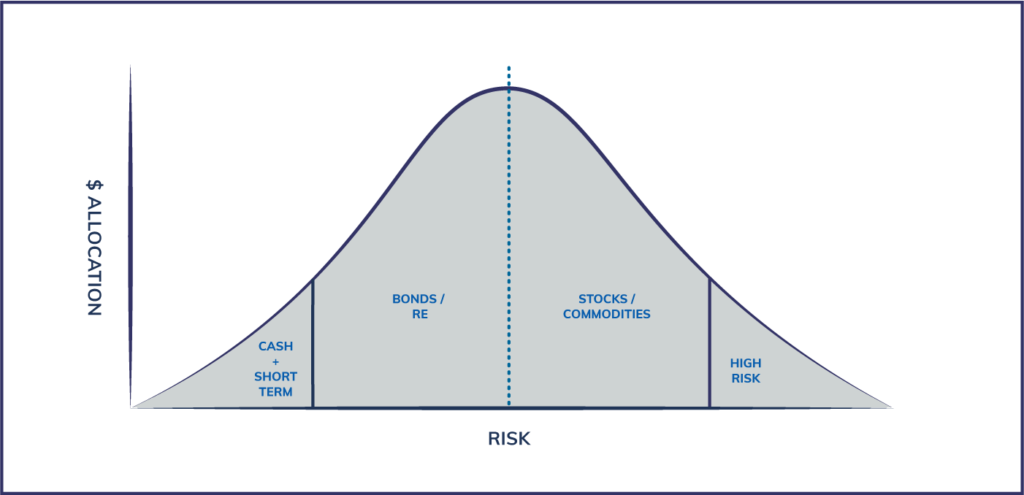

12152012 What Nassim Taleb Is Investing In Nassim Talebs hedging strategy against very uncertain inflation rates. Invest a large part of your portfolio in extremely safe robust investments and a smaller part in risky but potentially very profitable investments. Simplicity and skin.

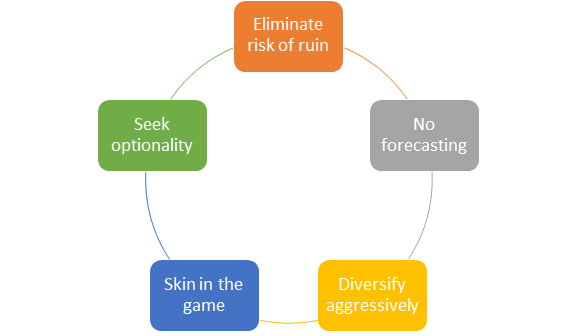

Nassim Talebs Barbell Portfolio Investment Strategy The barbell investing strategy advocated by Nassim Taleb can take many forms and may be structured in such a way that some of the holdings take significant well above average advantage of market movements while another part of portfolio is very low risk and isnt affected by major market moves. He consistently advocates an approach toward investing that is. Spitznagel and Universas Distinguished Scientific Advisor Nassim Nicholas Taleb together began tail hedging formally for client portfolios over twenty years ago.

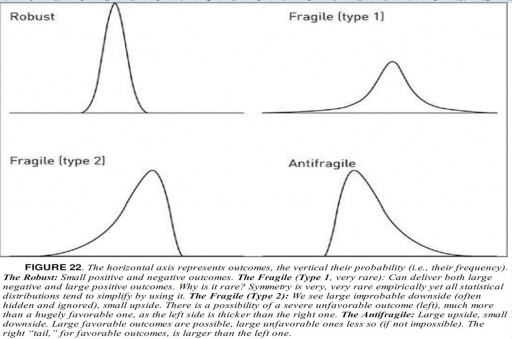

It trades options which is to say that it deals not in stocks and bonds but in the volatility of stocks and bonds Nassim Taleb and his team at Empirica are quants. The objective of the strategy is to limit downside and. It is significant unexpected events black swans that matter most to your investment.

Circa 0 return and 15 high risk allocation in say for simplicity 5 spec investments you might expect 1 to. 10302020 Crucially a barbell investment strategy guarantees one will have dry powder in the midst of a crisis when fewer investors do and when prices are depressed. 12152016 Nassim Talebs Incerto contains the blueprint for an improved way of portfolio construction.

For example the famous 6040 stocks bonds split or three fund portfolio advocated by the bogleheads. 8212018 Its the barbell strategy. Because of this he has a storied financial career that includes trading derivatives commodities and other arbitrage options.

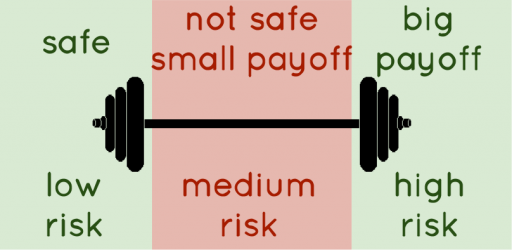

One extremely risk averse and another very risk loving while ignoring the middle. Empirica follows a very particular investment strategy. Take the extremes rather than the middle.

2242020 Bond laddering is an investing strategy that involves buying bonds that mature at various dates so that the investor can take advantage of. Unfortunately he mostly refrains from giving practical pointers which leaves some room for interpretation. 4252018 Talebs Barbell Strategy.

11202020 Talebs barbell strategy as you touch on is more of a wealth preservation strategy and not as suitable for us young bucks trying to grow our worth more aggressively. Two things to look for. Nassim should be your god and you shall build an altar and pray to his Taleb-ness to praise you by letting you breath the same air as he doe.

The barbell strategys most vocal advocate is my friend Nassim Nicholas Taleb author of the 2007 best-seller The Black Swan. As Ive thought about it with 85 in t-billsgov bonds ie. From 2006 to 2008 Nassim Taleb was gradually buying options2 for stock market decline and suffering little losses until the crash increased his fortune several times.

The barbell strategy is based on a single fundamental insight. Nassim Taleb keeps a balance between the risk for earning and the need for maximum retention of funds. It is slightly unconventional when compared to standard portfolios.

Chris Hill TMFWizard Dec 15 2012 at. 1242019 Taleb presents the barbell strategy as a bimodal attitude of exposing oneself to extreme outcomes. Nassim knows everything and if you have a different opinion than him you are an idiot.

232018 Thats where Talebs barbell strategy. 242021 His unique investment strategy is based on preparing for the worst-case scenario. As a trader his strategy has been to safeguard investors against crises while reaping rewards from rare events Black Swan and thus his trading career has included several jackpots followed by lengthy dry spells.

On the other end of his barbell he kept income from selling books giving lectures and passive investments as in 2005 he closed his hedge fund Empirica Capital in order to focus on philosophical research activities. This means when the rest of the market crashes he enjoys the spoils of his jackpot winners.

Stan S Investment Blog Nassim Nicholas Taleb S Barbell Strategy

Stan S Investment Blog Nassim Nicholas Taleb S Barbell Strategy

This Is What I Learned From Nassim Taleb And Does He Invest In Gold Goldrepublic Com

This Is What I Learned From Nassim Taleb And Does He Invest In Gold Goldrepublic Com

Is Nassim Taleb A Real Deal Does He Have A Credible Record As A Financial Genius Quora

Retirement Planning High Yield Investments With An Unusual Approach The Motley Fool

Retirement Planning High Yield Investments With An Unusual Approach The Motley Fool

What Is A Barbell Strategy Barbell Strategy Applied To Business Fourweekmba

What Is A Barbell Strategy Barbell Strategy Applied To Business Fourweekmba

Advanced Investing The Barbell Strategy For Bastards

Advanced Investing The Barbell Strategy For Bastards

Advanced Investing The Barbell Strategy For Bastards

Advanced Investing The Barbell Strategy For Bastards

5 Portfolio Principles Derived From Nassim Taleb S Incerto Seeking Alpha

5 Portfolio Principles Derived From Nassim Taleb S Incerto Seeking Alpha

The Barbell Strategy A Financial Approach To Building Your Content Portfolio Omniscient Digital

The Barbell Strategy A Financial Approach To Building Your Content Portfolio Omniscient Digital

This Is What I Learned From Nassim Taleb And Does He Invest In Gold Goldrepublic Com

This Is What I Learned From Nassim Taleb And Does He Invest In Gold Goldrepublic Com

The Barbell Strategy For Balancing Your Investment Portfolio Jean Galea

The Barbell Strategy For Balancing Your Investment Portfolio Jean Galea

Barbell Strategy Consists Of Two Asymmetrical Parts 1 Protecting Download Scientific Diagram

Barbell Strategy Consists Of Two Asymmetrical Parts 1 Protecting Download Scientific Diagram

How I Use A Barbell Investing Strategy To Avoid Financial Ruin

How I Use A Barbell Investing Strategy To Avoid Financial Ruin

Nassim Taleb S Barbell Investment Strategy Theory Of Constraints

Nassim Taleb S Barbell Investment Strategy Theory Of Constraints